How to Interpret Regression Output in Excel

The dissertation buzz is on and students

are doing everything possible to meet up with the deadline. This is the current

atmosphere in tertiary institutions, at least for those with undisrupted

academic calendar J. The students

are in different stages of their project,

as it is commonly called. Some are yet to wrap up their chapter one which gives

the “study background” and the framing of research hypotheses, objectives and

questions. Some have moved on to chapter two reviewing relevant literature

related to their scope of study. Others have gone further in developing both

the theoretical and empirical frameworks for chapter three, but not without the

usual teething lags…but they’ll get around it, somehow J. A handful have even done better

by progressing to chapter four attempting to analyse their data.

Since, chapters one to three are

relative to each students’ scope of research, however, a regression output is

common to all (although actual outcomes differ). It is based on this that I decided

to do a tutorial in explaining the basic features in a regression output. Likewise,

this write-up is in response to requests received from readers on (1) what some

specific figures in a regression output are and (2) how to interpret their

results. Let me state here that regardless of the analytical software whether

Stata, EViews, SPSS, R, Python, Excel etc. what you obtain in a regression

output is common to all analytical packages (except where slight variations

occur).

For instance, in undertaking an ordinary

least squares (OLS) estimation using any of these applications, the regression

output will churn out the ANOVA (analysis of variance) table, F-statistic, R-squared, prob-values, coefficient, standard error, t-statistic, degrees of freedom, 95%

confidence interval and so on. These are the features of a regression output.

However, the issue is: what do these mean and how can they be interpreted and

related to a research.

Hence, the essence of this tutorial is

to teach students the relevance of these features and how to interpret their

results. I will be using Excel

analytical package to explain a regression output, but you can practise along

using any analytical package of your choice. (See tutorial for Stata and EViews users).

An Example: Use Gujarati and Porter Table7_12.dta

or Table7_12.xlsx dataset

Note: I will not be discussing

stationarity or cointegration analysis in this tutorial (that will come later on). Since the issue on how to understand the features of a regression output and interpret results, I will just be doing a simple linear regression

analysis (a bi-variate analysis) with only one explanatory variable.

The dataset is on the United States from

1960 to 2009 (50 years data). The outcome variable is consumption expenditure (pce) and the explanatory variable is

income (income).

First step: get the Data Analysis Add-in menu

Before you begin, ensure that the DATA ANALYSIS Add-in is in your tool

bar because without it, you cannot perform any regression analysis. To obtain it

follow this guide:

File >> Options >> Add-ins >> Excel

Options dialog box opens

Under Active Application Add-ins, choose Analysis ToolPak

In the Manage section, choose Excel

Add-ins

Click Go, then OK

If it is correctly done, you should see

this:

|

| Excel Add-in Dialog Box Source: CrunchEconometrix |

And you will have the Data Analysis menu to your extreme top-right corner under Data menu:

Second step: have your data ready

Here is the data in excel format:

Third step: Visualise the relationship between the variables

Before analysing the data, it is good to

always graph the dependent and key explanatory variable (using a scatter plot)

in order to observe the pattern between them. This gives you what to expect in

your actual analysis. Here’s the procedure:

1.

Highlight

the 2 columns that contain the variables

2.

Go

to Insert >> Charts >> Scatter

|

| Excel - Scatter plot of pce and income Source: CrunchEconometrix |

The graph indicates a positive

relationship between the two variables. This seems plausible because the higher

your income, the higher will be your consumption, except you are very frugalJ.

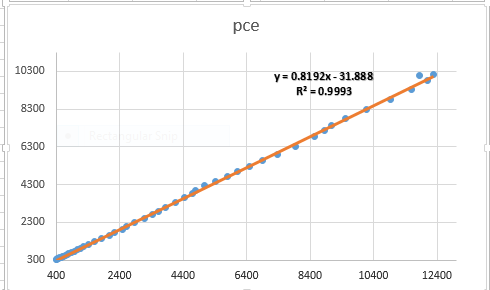

The graph can be formatted by adding a

trend line (see video on how to do this). In Excel, adding a trendline also

gives you the linear prediction:

As can be seen from the second graph, we

have the linear prediction for pce

and the R2.

Fourth step: The scientific investigation

Now we want to scientifically

investigate the relationship between pce

and income. To do this, go to Data >> Data Analysis (dialogue box opens) >> Regression >> OK.

|

| Excel - Data Analysis Dialogue Box Source: Crunch Econometrix |

Once you click OK, the Regression

dialogue box opens:

|

| Excel - Regression Dialogue Box Source: CrunchEconometrix |

·

Put

data range for pce under Input Y

Range

·

Put

data range for income under Input X

Range

·

Check

label box

·

Check

Confidence Level box

·

Check

Output range

·

Click

OK

(You have simply told Excel to regress the dependent

variable, pce, on the explanatory

variable, income), and the output is

shown as:

Fifth step: The features of a regression output

The Excel output gives the Regression Statistics and the ANOVA table. So what do these figures

mean? I will explain each feature in turns.

Under

“Regression Statistics”:

R-squared: gives the

variation in pce that is explained by

income. The higher the R2, the better the model and

the more predictive power the variables have. Although, an R2 that equals 1 will elicit some suspicion. The R is

actually the correlation coefficient between the 2 variables. This implies that

= the correlation coefficient.

Adjusted R-squared: this is the R2 adjusted as you increase your explanatory variables.

It reduces as more explanatory variables are added.

Standard

Error:

this is the standard error of the regression

Observations: the data span

is from 1960 to 2009 = 50 years

Under

“ANOVA” (analysis of variance):

Source: there are two

sources of variation on the dependent variable, pce. Those explained by the regression (i.e, the Model)

and those due to randomness (Residuals)

df: this is degree of freedom calculated as k-1 (for the model) and

n-k (for the residuals)

SS: implies sum of squared residuals for the Regression

(explained variation in pce) and

Residuals (unexplained variation in pce).

After doing the regression analysis, all the points on pce do not fall on the predicted line. Those points outside the

line are known as residuals. Those

that can be explained by the regression are known as Explained Sum of Squares (ESS) while those that are due to random

forces, which are outside the model are known as Residual Sum of Squares (RSS).

|

| Excel - Predicted Value of pce Source: CrunchEconomterix |

As observed from the graph, all the

points do not fall on the predicted line. Some lie above, while some are

beneath the line. These are all the residuals (in order words, the remnants obtained

after the regression analysis). If the predicted line falls above a point, it

means that pce is over-predicted

(that is, pce – pcehat is

negative) and if it is beneath a point, it implies that pce is under-predicted (that is, pce – pcehat is positive). The sum and mean of the residuals

equals zero.

MS: implies mean sum of squared residuals obtained by dividing SS by df i.e. SS/df

F: captures whether the

explanatory variable, income is

significant in explaining the outcome variable, pce. The higher the F-stat, the better for the model.

Significance

F: this is the probability value

that indicates the statistical significance of the F ratio. A significance-value

that is less than 0.05 is often preferred.

Coefficient: this is the

slope coefficient. The estimate for income.

The sign of the coefficient also tells you the direction of the relationship. A

positive (negative) sign implies a positive (negative) relationship.

Intercept: this is the

hypothetical outcome on pce if income is zero. It is also the intercept

for the model.

Standard

error:

this is the standard deviation for the coefficient. That is, since you are not

so sure about the exact value for income,

there will be some variation in the prediction for the coefficient. Therefore,

the standard error shows how much deviation occurs from predicting the slope

coefficient estimate.

t-stat: this measures

the number of standard errors that the coefficient is from zero. It is obtained

by: coeff/std. error

P-value: there are

several interpretations for this. (1) it is smallest evidence required to

reject the null hypothesis, (2) it is the probability that one would have

obtained the slope coefficient value from the data if the actual slope

coefficient is zero, (3) the p-value looks up the t-stat table using the degree of freedom (df) to show the number of

standard errors the coefficient is from zero, (4) tells whether the

relationship is significant or not.

So, if the p-value is 0.3, then it means that you are only 70% (that is,

(100-30)% ) confident that the slope coefficient is non-zero. This is not good

enough. This is because a very low p-value

gives a higher level of confidence in rejecting the null hypothesis. Hence, a p-value of 0.02, implies that you are

98% (that is, (100 - 2)% ) confident that the slope coefficient is non-zero

which is more re-assuring! J.

Lower

and Upper 95%:

these are the confidence intervals. If the coefficient is significant, this

interval will contain that slope coefficient but it will not, if otherwise.

Assignment:

Use Gujarati and Porter Table7_12.dta or

Table7_12.xlsx dataset.

(1) With pce

as the dependent variable and gdpi as

the explanatory variable, plot the graph of pce

and gdpi, what do you observe?

(2) Run your regression. Can you interpret the

table and the features?

(3) Plot the predicted line. What are your

observations?

I have taken you through the basic

features of a regression output using Excel data analysis software on ordinary

least squares (OLS) model in a simple linear regression. So, you now have the

basic idea of what the F-stat, t-stat, df, SS, MS, prob>F, p>|t|,

confidence interval, R2,

coefficient, standard error stand for.

[Watch video on "How to interpret regression output in Excel"]

Practice the assignment and if you still

have further questions, kindly post them below....

No comments:

Post a Comment