After

unit root testing, what next?

The outcome of

unit root testing matters for the empirical model to be estimated. The

following scenarios explain the implications of unit root testing for further

analysis. Still drawing on the previous tutorials

(see here for EViews, Stata and Excel) on unit root testing with the augmented

Dickey-Fuller procedure (see videos), we are using the same data from Gujarati and Porter Table 21.1 quarterly data of 1970q1 to 1991q4. The variables in

question are pce, pdi and gdp in natural logarithms.

Scenario

1: When series under scrutiny are

stationary in levels.

In this scenario, it is assumed that lnpce, lnpdi and lngdp are

stationary in levels, that is, they are I(0)

series (integrated of order zero). In

this situation, performing a cointegration test is not

necessary. This is because any shock to the system in the short run quickly

adjusts to the long-run. Consequently, only the long

run model should be estimated using OLS (where variables are neither

lagged nor differenced). It is the static form of the model. In essence, the

estimation of short run model is not necessary if series are I(0).

Scenario

2: When series are stationary in first differences.

1.

Under this scenario, the series are

assumed to be non-stationary but became stationary after first difference

2.

One special feature of this is that they

are of the same order of integration.

3. Under this scenario, the model in

question is not entirely useless although the variables are unpredictable. To

verify further the relevance of the model, there is need to test for cointegration. That is, can we assume a long run

relationship in the model despite the fact that the series are drifting apart

or trending either upward or downward?

4. There are however, two prominent

cointegration tests for I(I) series

in the literature. They are Engle-Granger cointegration test and Johansen

Cointegration test.

5. The Engle-Granger test is meant for

single equation model while Johansen cointegration test is considered when

dealing with multiple equations.

If there is cointegration:

1.

Implies that the series in question are

related and therefore can be combined in a linear fashion.

2. That is, even if there are shocks in the

short run, which may affect movement in the individual series, they would

converge with time (in the long run).

3.

Estimate both long-run and short-run

models.

4. The estimation will require the use of

vector autoregressive (VAR) model and vector error correction model (VECM)

analysis.

If

there is no cointegration:

1.

Estimate only the short-run model, which

is VAR and not VECM.

Johansen

Cointegration Test in EViews

The hypothesis

is stated as:

H0:

no cointegrating equation

H1: H0

is not true

Rejection of the null hypothesis is at the 5% level.

Note: Cointegration test should be performed on the level

form of the variables and not on their first difference. It is okay to also use

the log-transformation of the raw variables, as I have done in this example.

Steps:

1.

Load data into EViews (see video on how

to do this)

2.

Open as Group data (see video on how to

do this)

3.

Go to Quick >> Group Statistics >> Johansen Cointegration

>> dialog box opens >> list the variables >> Click OK

>> Select option 3 [Intercept (no trend)] >> Click OK

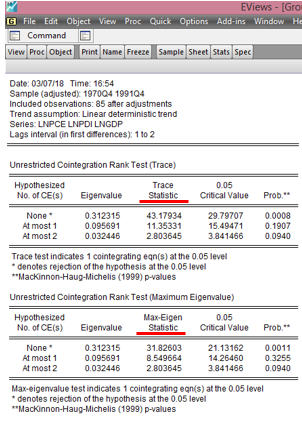

Here is the

EViews result on the Johansen Cointegration test of lnpce, lnpdi and lngdp:

|

| EViews - Johansen Cointegration Test Source: CrucnhEconometrix |

Interpreting

Johansen Cointegration Test Results

1.

The EViews output releases two

statistics, Trace Statistic and Max-Eigen Statistic

2.

Rejection criteria is at 0.05 level

3.

Rejection of the null hypothesis is

indicated by an asterisk sign (*)

4.

Reject the null hypothesis if the

probability value is less than or equal to 0.05

5.

Reject the null hypothesis if the Trace

or Max-Eigen statistic is higher than the 0.05 critical value

Decision: Given the results generated,

the null hypothesis of no cointegrating equation is rejected at the 5% level.

Hence, it is concluded that a long-run relationship exist among the three

variables.

[Watch video on how to conduct Johansen cointegration test in EViews]

However, if the

null hypothesis cannot be rejected, it evidences no cointegration and hence

there is no long-run relationship among the series. This implies that, if there

are shocks to the system, the model is not likely to converge in the long-run. In

addition, if there is no cointegration, only the short run model should be estimated. That is, estimates

only VAR do not estimate a VECM!